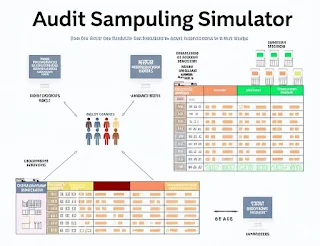

Audit Sampling Simulator

An Interactive Guide to Attribute Sampling for Tests of Controls

Step 1: Understand the Risks

Sampling risk is the chance that your sample isn't representative of the whole population. This can lead to incorrect conclusions. In auditing, these risks fall into two categories: those affecting the **effectiveness** of the audit (doing the wrong thing) and those affecting its **efficiency** (doing more work than needed).

For Tests of Controls (Attribute Sampling)

Risk of Assessing Control Risk Too Low

Your sample says a control is effective when it's not.

Impact: Ineffective Audit. You rely on a bad control and may not detect a material misstatement.

Risk of Assessing Control Risk Too High

Your sample says a control is ineffective when it's actually fine.

Impact: Inefficient Audit. You do more substantive testing than necessary.

For Substantive Tests (Variables Sampling)

Risk of Incorrect Acceptance

Your sample says an account balance is okay when it's materially misstated.

Impact: Ineffective Audit. You could issue an incorrect audit opinion.

Risk of Incorrect Rejection

Your sample says an account balance is misstated when it's actually fine.

Impact: Inefficient Audit. You perform unnecessary procedures and may upset the client.

Step 2: Plan Your Sample Size

Determining the right sample size is a balancing act. You need enough evidence without over-auditing. For attribute sampling, three key factors drive your sample size. Use the sliders below to see how they interact.

Maximum error rate you can accept and still rely on the control. (Higher rate = smaller sample)

Your best guess of the error rate before you start. (Higher rate = larger sample)

The risk you're willing to take of being wrong. (Higher risk = smaller sample)

Calculated Sample Size:

78

Step 3: Evaluate Your Results & Conclude

After testing your sample, you must evaluate the results to make a final decision. The key is to compare your **Upper Deviation Rate** (your sample's error rate plus a cushion for sampling risk) to your pre-defined **Tolerable Deviation Rate**.